How Much Is Your House Worth? Picking a Home Value Estimator

Last updated May 7, 2025

As a homeowner, you probably know that your home is likely your biggest asset. But do you know how much your house is worth?

Even if you’re not planning to sell your home any time soon, knowing its approximate value can be beneficial for a number of reasons. And while a home’s true value is only determined when it sells, home value estimator tools can provide a reasonable approximation. When you have an up-to-date and accurate value, you can make more confident decisions about how to leverage your home equity.

For example, if you’re planning on making renovations to increase your home’s value, but your property is among the highest valued in your particular neighborhood, it might not be worth pursuing the improvements since they may not yield a return on investment that’s significant enough to justify the cost, time and effort of the project.

Or, if you’re looking at refinancing or opening a home equity line of credit (HELOC), you’ll need to have a minimum amount of equity in your home to do so, and the more you know about the general amount you’ve built up, the better off you’ll be as you go through that process.

Regardless of your plans, unexpected events can often pop up in life. When you have a sense of your home’s worth, you’ll be better prepared to handle anything that comes your way. Read on to find out what goes into determining your home value, and the best ways to calculate it.

How do I calculate my home value?

Home value is multifaceted, and unfortunately, there isn’t one foolproof way to calculate it before a home sale; then and only then, its ultimate value is determined. However, it’s still important to get a ballpark range in order to better plan for the future. As a homeowner, it can be not only incredibly disappointing to receive a falsely inflated home value estimate, it can also have unexpected and unwanted implications when it comes to qualifying for financing, selling your home, and more.

There are a number of online home value calculators and estimators available to use that allow homeowners to get a relatively accurate idea of what their home is worth without paying for an appraisal. However, because there isn’t one standard formula, each website, company, and provider has slightly different criteria that goes into their calculation, sometimes including their own proprietary algorithms as well as automated valuation models (AVMs) from various real estate databases like Black Knight or CoreLogic.

One of the elements that often remains consistent across the board when it comes to home value estimators is the use of “comps,” or comparable properties in the vicinity of a particular home that have recently sold. These homes are also similar in size (within 300 square feet), acreage, floor plan, bed and bathroom counts. You can find comps by navigating to “just sold” properties on websites like Realtor.com or Zillow — and while you might have some wiggle room, limit your timeframe to the past 60 days to keep the search as recent as possible.

While comps can certainly provide a solid sense of the value of similar homes and yours in turn, be wary of estimators that rely solely on comps without taking additional data into account, as they may result in a one dimensional figure that is less accurate than that of other providers.

What is the best estimator for home value?

As we touched on when we talked about calculating it, home value has multiple dimensions, and (unfortunately) there isn’t just one formula or website that can promise a value that’s 100% accurate. However, when seeking out home value estimators, it’s often a smart idea to find one that uses multiple sources of reliable data to come up with their number.

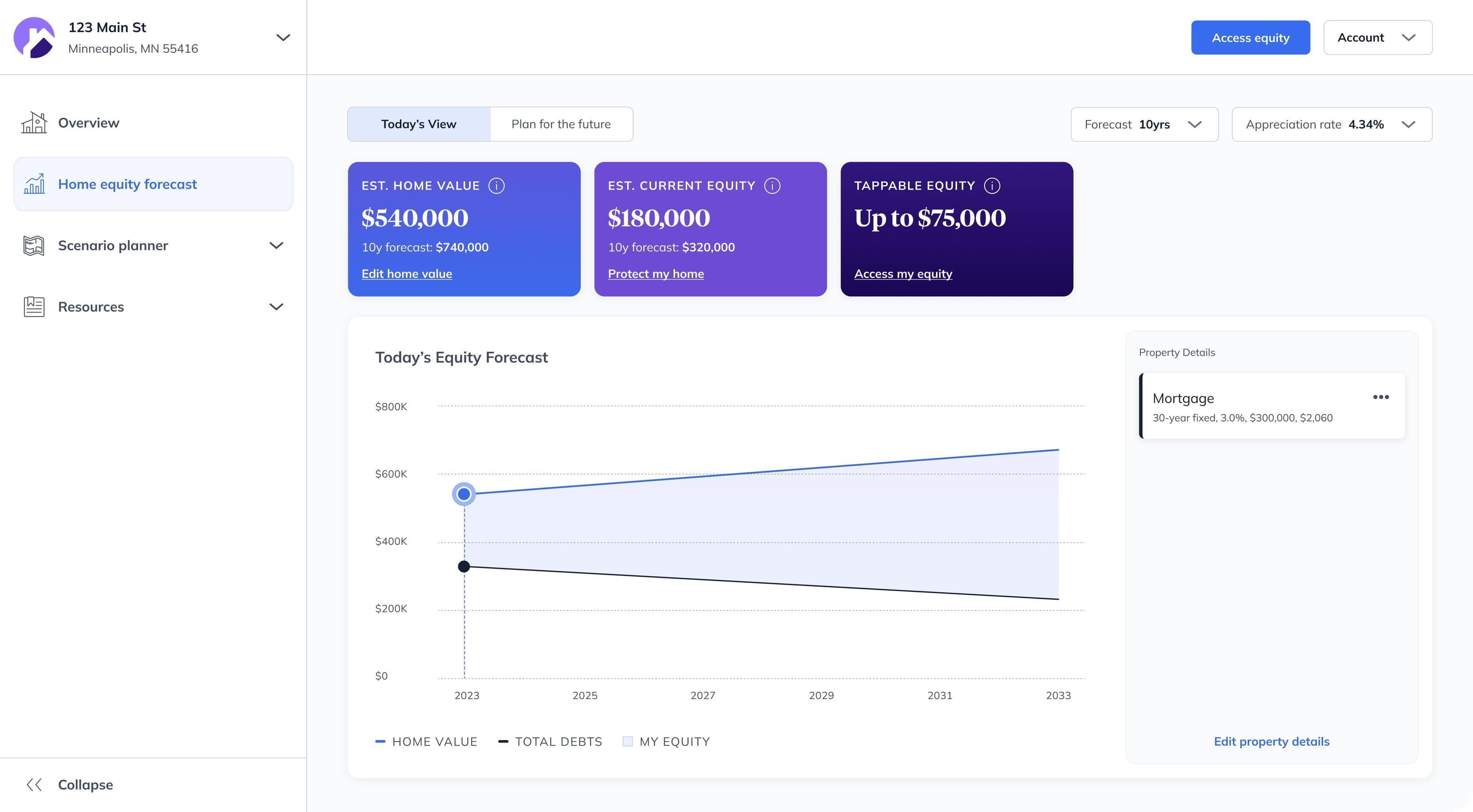

Many real estate websites that offer home value estimators largely rely on MLS data about recently-sold properties or even public and-owner-submitted data about home details and sale history, which can be unreliable. Hometap’s Home Value Estimate uses a curated blend of multiple industry-proven data sources to give you a reliable, up-to-date number you can trust. It also has a forecasting feature so that you can anticipate your home’s future value as much as ten years from now. Here's a sample of what our home value estimate tool looks like:

While no home value estimator can promise 100% accuracy, it’s important to note there are some factors that can lead to minor inaccuracies in the estimated value of your home, including undocumented renovations you’ve made or extremely recent home sales or market trend changes in your area.

How can I estimate the value of my property?

Short of using a home value estimator, there is a way you can roughly estimate the appraisal price of your home using a combination of comparable recently sold homes in your neighborhood and your home’s square footage.

While you can use as many comps as you’d like — preferably in your immediate area — it might be easier to limit it to four or five maximum, as this does involve some (easy) math!

Once you’ve gathered the comps, you’ll want to divide the selling price of each home by its total square footage to determine the price per square foot.

Then, add up the price per square foot of each comp you’ve looked at, divide that total by the total number of comps, and multiply that number by your home’s total square footage.

We illustrated this equation with some sample comps here.

Again, this isn’t a hard and fast determination of your home’s value, but it can give you a better idea if you haven’t been keeping track of local home sales.

What is the best predictor of home value?

Just as there isn’t a singular way to calculate home value, there isn’t a singular predictor of home value. But if you’ve lived in your home a long time and haven’t kept up with its worth over the years, looking at the prices of recently sold homes in your area can give you a good starting point to get a ballpark range so you’re not caught completely off guard. Relatedly, there are some general and market trends that can affect your home’s value.

Typically, time treats home value favorably, and your home’s worth is likely to increase over the long term so long as you keep up with regular maintenance and quickly address any issues that arise to avoid major and costly damage.

Your neighborhood can also have a significant impact on your home’s value. This encompasses the qualities of its physical location, like behind a busy highway or on a secluded cul-de-sac, come into play along with the broader factors like crime statistics, school quality, and job opportunities. On a larger scale, your state, city, and even region within the city can also make a difference, as places with an abundance of career opportunities drive demand for housing and cause prices to climb. And on a national level, slowdowns in the economy can directly impact the growth of home prices, as demand will wane as a result.

Read more about factors that contribute to home value appreciation

Monitor Your Home Value

While you obviously can’t always control these factors, staying on top of and aware of your home’s value goes a long way to help you as a homeowner in terms of maintaining — and even growing — it in the future. And fortunately, you can access Hometap’s free home value estimator any time through your Home Equity Dashboard to get a sense of your home’s current value and equity, plus forecasted estimates for 10 years down the road.

Get started today by signing up for or logging into Hometap’s Home Equity Dashboard. In addition to the free Home Value Estimate, you can also calculate average costs and return on investment of renovations, access best-in-class home service providers, and get valuable, personalized insights to help you make the most of homeownership.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.