How Hometap Compares to Other Home Equity Investment Companies

Whether you’re looking to improve the value of your home, fund a new business, pay off debt, or even invest in another property, home equity investments can be a great way to get some much-needed cash quickly.

A home equity investment is a sum of money granted to homeowners in exchange for an investment in the homeowner’s residential property. Unlike traditional home equity solutions—fixed-rate home equity loans, home equity lines of credit (HELOCs), cash-out refinances, reverse mortgages, and the like—a home equity investment has no monthly payments, making it an attractive alternative.

While home equity investment companies are still relatively new to the real estate scene, there are several companies that offer similar products. Understanding the nuances of each is imperative for homeowners who are considering taking on an investor in their home.

Most home equity investment and home equity agreement providers follow a similar process: the homeowner completes an application, receives an investment estimate, arranges an appraisal to determine the home’s market value, and is given an official investment offer. Where the companies can differ includes factors like:

- Term length (how long the homeowner has to settle the investment

- Qualification terms, such as home type, location of home, credit score, and loan-to-value ratio

- Closing fees

- Investment size

- Investment structure

The Main Difference Between Home Equity Investment Providers

Within the investment structure is where you’ll find the biggest difference between home equity investment providers. This includes the percentage of the home’s future value an investor will be entitled to receive when you sell, refinance, or buy them out, and what other factors are included in the settlement total.

At or before the end of the term (which tends to vary from ten to 30 years), the homeowner pays the investor a share of their home’s current value, following an unbiased appraisal from an independent third party appraiser. The minimum and maximum investment and settlement amounts will vary by investor. With some investors, including Hometap, this range will be given before any agreement is reached, so there are no surprises. In other cases, that range is variable, making it difficult to quantify.

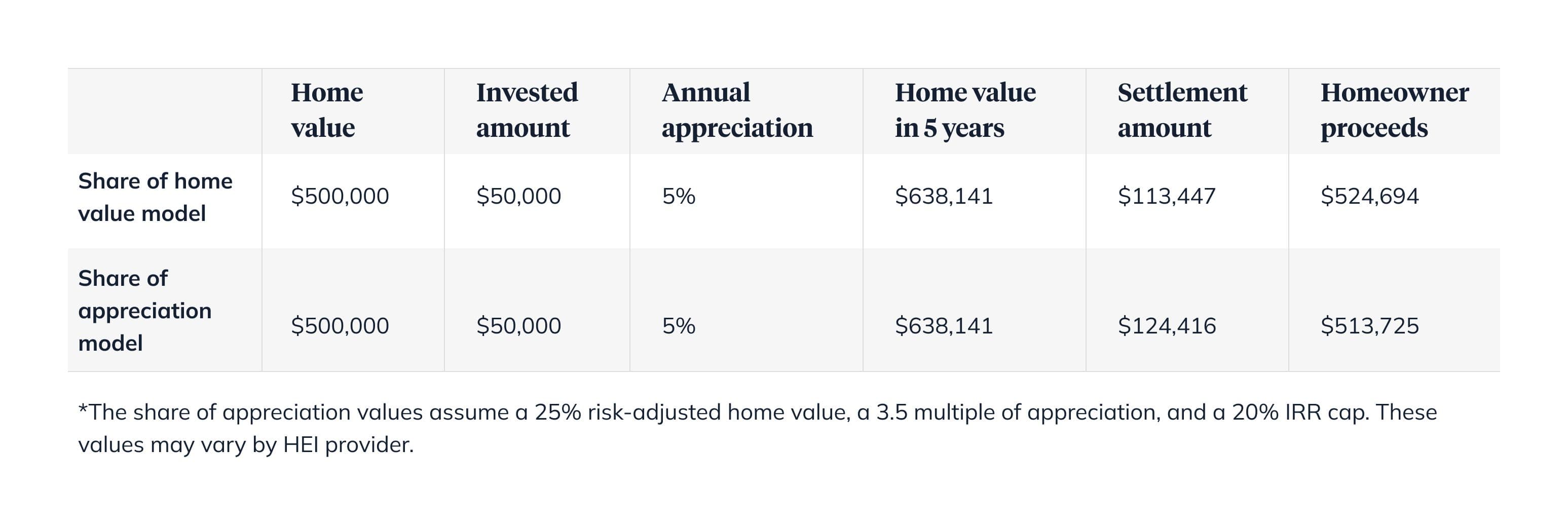

Most home equity investment providers use one of two models to determine the settlement total: share of home value and share of home appreciation. The option you choose can impact the amount you owe at settlement.

The Share of Home Value Model

In this model, the investor provides the homeowner with a lump sum of cash in exchange for a minority stake in the future value of the home. When the investment’s term ends or the house is sold, the homeowner pays an agreed-upon percentage of the current home market value to the investor. This means that if the home depreciated in value within the term, the percentage owed will be less, and the investor may not make a profit. This is the model that Hometap follows.

The Share of Appreciation Model

In this model, the investor provides the homeowner with a lump sum of cash in exchange for a percent of the home’s future appreciation. When the home sells or the investment term ends, the homeowner pays the original investment amount, plus a variable percent of the home’s appreciation.

Home Value or Home Appreciation Agreements: Which One is Right For You?

Determining the best way to make use of your home equity depends on three key factors: your home’s current value, how many investment dollars you’re hoping to use, and the length and terms of the investment itself.

It’s impossible to calculate precisely how much an investment settlement will be, because nobody can perfectly predict how the housing market will perform. It is, however, possible to come up with some ballpark estimates using a few basic numbers.

This chart illustrates how these two models play out for a $500,000 home with a $50,000 investment over five years, assuming there is a five percent annual appreciation.

If you have an idea of your home’s value and an investment estimate, you can insert your numbers to get an idea of how much you may owe at settlement for each model.

Of course, this is just one factor you’ll want to consider when comparing your options for accessing your home equity.

For more information on the difference between the share of home value and share of home appreciation models, and for a side-by-side comparison of all your options for accessing your home equity, download our Home Equity Investments 101 Guide.

Tap into your equity with no monthly payments. See if you prequalify for a Hometap investment in less than 30 seconds.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.